How to Link Aadhaar with PAN – Step-by-Step Guide (2026 Updated)

Linking Aadhaar with PAN is mandatory for Indian taxpayers. If your Aadhaar is not linked with your PAN, your PAN can become inoperative, which means you won’t be able to file income tax returns, open bank accounts, or perform many financial transactions.

In this complete guide, you’ll learn how to link Aadhaar with PAN online, offline methods, penalty details, common errors, FAQs, and all related solutions. This article is written in a Google-friendly, human-first format to help it rank better and stay safe from algorithm updates.

Why Aadhaar-PAN Linking Is Important

The Government of India introduced Aadhaar-PAN linking to:

-

Eliminate duplicate PAN cards

-

Track tax evasion

-

Simplify KYC verification

-

Improve transparency in financial systems

According to the Income Tax Department, Aadhaar-PAN linking is compulsory under Section 139AA of the Income Tax Act.

Who Needs to Link Aadhaar with PAN?

You must link Aadhaar with PAN if:

-

You are an Indian citizen

-

You have a valid PAN card

-

You file Income Tax Returns (ITR)

-

You use PAN for banking, investments, or KYC

Not required for:

-

NRIs

-

Individuals aged above 80 years

-

Foreign citizens

Aadhaar-PAN Linking Deadline & Penalty

-

Current status: Linking is still allowed but with a penalty of ₹1,000

-

If not linked, PAN becomes inoperative

-

An inoperative PAN cannot be used for:

-

Filing ITR

-

Opening bank accounts

-

Mutual funds & stock trading

-

High-value transactions

-

How to Link Aadhaar with PAN Online (Official Method)

Follow these simple steps:

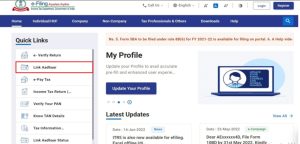

Step 1: Visit the Official Portal

Go to the Income Tax e-Filing website.

Step 2: Click on “Link Aadhaar”

On the homepage, select “Link Aadhaar”.

Step 3: Enter Details

Fill in:

-

PAN number

-

Aadhaar number

-

Name (as per Aadhaar)

Step 4: Pay Penalty (if applicable)

If linking after the due date, pay ₹1,000 online.

Step 5: OTP Verification

Enter the OTP sent to your Aadhaar-linked mobile number.

Step 6: Confirmation

Once verified, you’ll see a successful linking message.

How to Link Aadhaar with PAN Using SMS (Offline Method)

If you don’t have internet access, use SMS:

UIDPAN <Aadhaar Number> <PAN Number>

Format: