Social Security Benefits 2025 Increase: What You Need to Know

Introduction

As 2025 approaches, millions of Americans who rely on Social Security benefits are eager to know what changes are in store. The annual increase in Social Security benefits, known as the Cost-of-Living Adjustment (COLA), is a critical factor for retirees, disabled individuals, and others who depend on this financial support. In this blog, we’ll explore what the 2025 Social Security benefits increase entails, how it’s determined, and what it means for beneficiaries.

What is the Cost-of-Living Adjustment (COLA)?

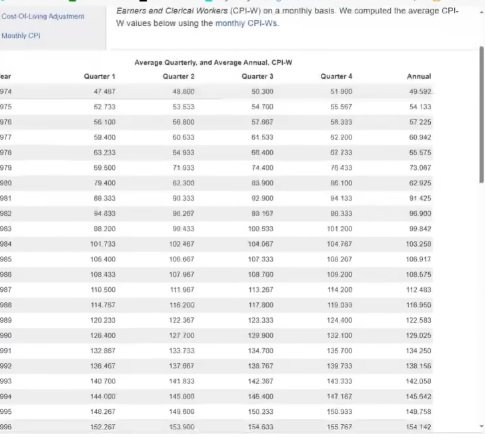

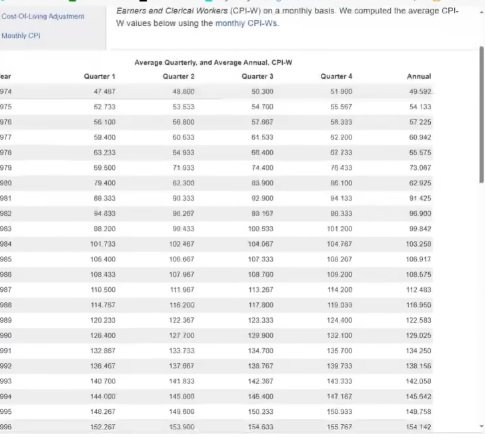

The Cost-of-Living Adjustment (COLA) is an annual increase in Social Security benefits designed to keep pace with inflation. It ensures that the purchasing power of Social Security benefits does not diminish over time due to rising prices. The Social Security Administration (SSA) calculates the COLA based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in the cost of goods and services.

Expected Increase for 2025

While the exact COLA for 2025 won’t be determined until later in 2024, early predictions suggest that beneficiaries might see a modest increase in their monthly payments. Economic experts and analysts monitor inflation trends closely throughout the year to provide an estimate of the potential COLA. As of now, here are some factors influencing the expected increase:

- Inflation Rates:

- The rate of inflation has a direct impact on the COLA. If inflation remains relatively stable or increases slightly, the COLA for 2025 may be modest, likely in the range of 2% to 3%. However, if inflation rises significantly, the COLA could be higher.

- Economic Conditions:

- Broader economic conditions, such as supply chain disruptions, labor market trends, and energy prices, can also influence inflation and, consequently, the COLA. Economic recovery post-pandemic, coupled with global events, may affect these factors.

- Historical Context:

- Historically, COLA increases have varied. For example, in 2023, the COLA was 8.7%, reflecting high inflation. In contrast, the increase in 2024 was expected to be lower due to a slowdown in inflation. The 2025 adjustment will likely follow this trend of aligning with current inflation rates.

How Will the Increase Impact Beneficiaries?

For Social Security beneficiaries, even a modest COLA increase can make a significant difference. Here’s what the 2025 increase could mean:

- Higher Monthly Payments:

- The primary benefit of a COLA is an increase in monthly Social Security payments. For example, if the COLA is 2.5%, a retiree receiving $1,500 per month would see their payment increase by $37.50, resulting in a new monthly payment of $1,537.50.

- Adjustments to Supplemental Security Income (SSI):

- In addition to Social Security retirement benefits, the COLA also affects Supplemental Security Income (SSI) payments. Individuals receiving SSI will see a similar percentage increase in their benefits.

- Impact on Medicare Premiums:

- Medicare Part B premiums, which cover physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items, often increase as well. In some years, higher Medicare premiums may offset a portion of the Social Security COLA, particularly for those whose Medicare premiums are deducted from their Social Security payments.

- Long-Term Financial Planning:

- Beneficiaries should consider the COLA when planning their long-term finances. While the increase helps to mitigate the impact of inflation, it’s important to remember that other living expenses, such as housing, food, and healthcare, may rise at different rates.

What to Expect Moving Forward

As we move closer to 2025, beneficiaries should stay informed about the official COLA announcement, which typically occurs in October. The Social Security Administration will provide detailed information about the exact percentage increase and how it will be applied to benefits.

In addition to the COLA, it’s important to stay updated on other changes to Social Security, such as updates to the full retirement age, adjustments to earnings limits for those who continue to work while receiving benefits, and changes to the taxable earnings cap.

Conclusion

The anticipated Social Security benefits increase in 2025, driven by the Cost-of-Living Adjustment, is a vital aspect of financial security for millions of Americans. While the exact percentage increase will depend on economic conditions and inflation trends, beneficiaries can expect some relief in the face of rising living costs. As always, staying informed and planning ahead are key to maximizing the benefits of Social Security and ensuring a stable financial future.

Keywords:

- Social Security benefits 2025

- Cost-of-Living Adjustment 2025

- Social Security COLA 2025

- Social Security increase 2025

- Inflation and Social Security

- Medicare premiums and Social Security

- Supplemental Security Income increase 2025

This blog aims to provide a comprehensive overview of what to expect from the 2025 Social Security benefits increase and its implications for beneficiaries.

Read More Relevant Post-

Rancho Palos Verdes Evacuation Warning: Safety Tips US

Play Color Prediction online game @

BDG Game